Executive summary

- Q2 2025 revenue $144.5M, +36% YoY; gross profit $46.4M; gross margin 32.1%.

- Cash and marketable securities $749.3M; convertible notes and long-term borrowings total ~$427.1M principal outstanding; debt-to-equity ≈ 0.61.

- Backlog ≈ $1.0B of contracted missions; confirmed multi-launch deals and SDA program participation are material demand catalysts.

- Technicals: current price above 50d and 200d SMAs; RSI ~48 (neutral); short-term momentum constructive but sensitive to launch cadence and Neutron schedule.

- Verdict: Rocket Lab RKLB small launch vehicles investment thesis is centered on scalable Electron revenue plus optional upside from the Neutron medium-lift program; execution risk (Neutron schedule, launch cadence) and valuation sensitivity to backlog recognition drive asymmetric outcomes.

Summary fundamentals

- Latest quarter revenue (Q2 2025): $144,498,000.

- Revenue YoY % (Q2 2025): +36% year-over-year.

- Latest quarter EPS (Q2 2025, diluted GAAP): loss per share approximated −$0.13 for quarter; note EPS volatility from R&D and one-time items.

- EPS YoY %: improved operating loss vs prior year but still negative on GAAP net income (net loss $66.4M for quarter).

- Gross margin (Q2 2025): 32.1% (gross profit $46.4M / revenue $144.5M).

- Debt-to-equity (period end June 30, 2025): total debt instruments ~ $416.7M versus shareholders’ equity $688.5M → debt/equity ≈ 0.61.

- Market cap (late-Sept 2025 snapshot): ≈ $22.4B.

Detailed fundamental analysis

Revenue trends

Rocket Lab posted record quarterly revenue of $144.5M in Q2 2025, up 36% YoY, with product and service mixes shifting as Electron launch services and space systems bookings expanded. Service revenue growth reflects higher mission cadence and increased mission management/space-systems work. The company reported FY-to-date revenue of $267.1M for six months ended June 30, 2025.

The small-launch market remains demand-driven by constellation deployments, national security programs and commercial rideshare models; Rocket Lab’s backlog (≈ $1.0B reported in market commentary) underpins near-term revenue visibility if launches execute to schedule.

Margin drivers and operating efficiency

Gross margin expanded materially year-over-year to 32.1% for Q2 2025, a 650-basis-point improvement per company disclosure, driven by higher launch utilization, improved production throughput in space systems, and favorable product/service mix. R&D and SG&A remain large line items as Rocket Lab invests in Neutron and manufacturing capacity, producing consolidated operating losses despite gross-margin leverage.

Key margin levers investors must monitor: Electron launch cadence (direct revenue and fixed-cost absorption), Space Systems manufacturing scale, and Neutron development run-rate (capitalized vs expensed R&D).

Balance-sheet strength and liquidity

As of June 30, 2025 Rocket Lab reported $564.1M cash and cash equivalents and $185.2M in marketable securities (current + non-current), total cash & marketable securities $749.3M, and convertible notes plus term borrowings with aggregate principal ~ $427.1M. Management states existing liquidity sufficient for next twelve months, but capital needs for Neutron development or expansion could require additional financing or equity issuance.

Net leverage relative to equity is modest at face value, but maturity and covenant profiles of convertible notes and equipment financing are concentration risks; investors should track Note 10 (Loan Agreements) disclosures each quarter.

Valuation multiples

Conventional multiples are high when compared with legacy industrials because Rocket Lab is a fast-growth aerospace platform trading on projected launch cadence and Neutron optionality. TTM revenue per TradingView shown at ~$436M (year figure), market cap ~$22.4B implies Price/Sales > 50x on consolidated revenue if using market cap vs FY revenue-reflecting investor premium for growth and strategic market access. Evaluate valuation by separating recurring Electron revenue and space systems cashflows from Neutron optionality to avoid overpaying for pre-launch expectations.

Momentum & technical snapshot

- RSI(14): ~47.9 – neutral.

- MACD status: MACD positive (MACD > signal) and showing short-term bullish skew on some aggregators; mixed across timeframes.

- 50-day SMA: $46.33; 200-day SMA: $30.93; latest price trades above both SMAs (~$47.01), indicating bullish medium-term trend.

- 1-month return vs Nasdaq Composite: RKLB ~ −4.97% 1-month vs Nasdaq Composite ~ +4.4% 1-month – RKLB underperformed the index on a one-month basis.

- Average daily dollar volume: average daily volume ≈ 21.9M shares; at ~$47/share average daily dollar volume ≈ $1.03B.

Interpretation: price sits above moving averages, so momentum is constructive; RSI neutrality and recent pullback versus Nasdaq indicate event-driven sensitivity (earnings, launches, Neutron milestones).

Peer comparison

Direct, publicly traded peers in small-launch or commercial space services include Astra Space (ASTR) and Virgin Galactic (SPCE) as partial comparators; both have materially different business models and scale.

- Astra Space, Inc. (ASTR) – launch services peer: revenue remains immaterial at scale (TTM revenue very small; Astra’s commercial launch revenue has been limited), negative margins and continued cash burn; forward P/E not meaningful. Astra competes in the same small-launch TAM but lacks Rocket Lab’s backlog and space-systems vertical integration.

- Virgin Galactic Holdings, Inc. (SPCE) – adjacent space industry peer: Q2 2025 revenue $0.4M, focus on human spaceflight and Delta-Class product pivot; very different revenue profile and margin structure; forward multiples vary and often show negative EPS. Use SPCE as a high-volatility aero/space comparator rather than a direct launch services match.

Comparison takeaway: Rocket Lab’s revenue scale, backlog and improving gross margins differentiate it from early-stage public small-launch peers, supporting a higher valuation multiple conditional on Neutron execution and stable Electron cadence.

Latest earnings highlights & management guidance

- “Record quarterly revenue of $144.5 million, representing 36% year-over-year growth.”

- “Gross margin expanded 650 basis points year-over-year to 32.1%.”

- “Backlog remains healthy, supporting expected Q3 revenue between $140–$150 million.”

- “Neutron development progressing; Launch Complex 3 opened to support Neutron operations.”

Each bullet quotes company statements and investor-facing releases.

Strategic moves, catalysts & risks

Strategic catalysts

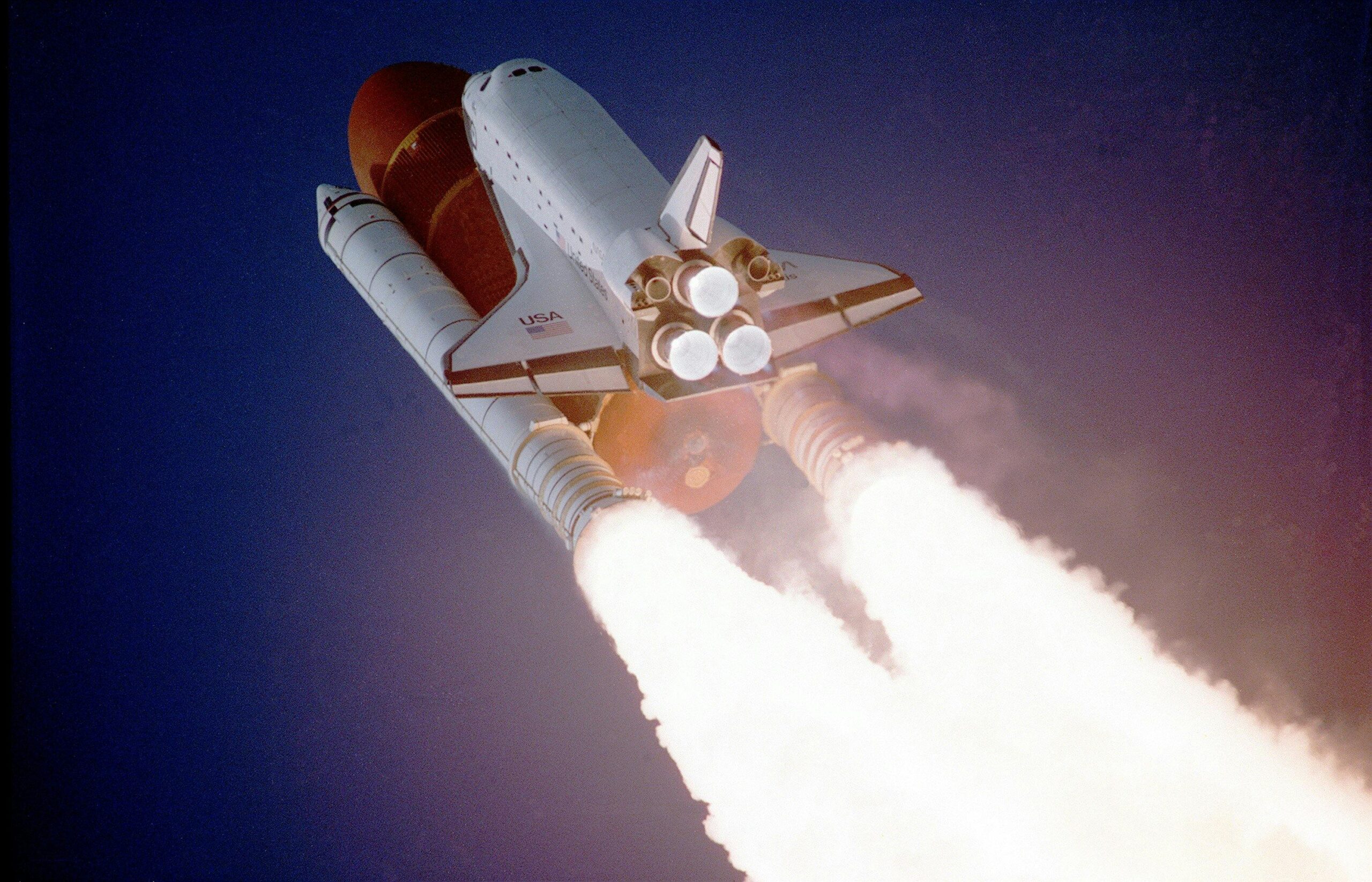

- Neutron program: reusable medium-lift vehicle designed for 13,000 kg to LEO; first flight targeted for late-2025 (subject to development risk); launch complex investments at Wallops (Launch Complex 3) are operational milestones. Successful Neutron first flight and early customer wins would materially re-rate addressable TAM and revenue potential.

- Backlog and multi-launch contracts: Synspective multi-launch deals and other commercial bookings provide near-term revenue visibility for Electron and mission services.

- Government programs: inclusion in U.S. national security launch programs (SDA/NSSL task orders) increases defense revenue optionality and credibility with institutional customers.

Material risks from filings/news

- Neutron execution and schedule risk: maiden flight delays or failures would depress optionality value and could force capital raises; investors must price high developmental risk into any Neutron upside.

- Revenue recognition concentration and cadence: backlog converts to revenue only with launches; schedule slippage or payload readiness delays compress near-term revenue.

- Capital intensity: continued investment in Neutron and manufacturing requires cash; while current liquidity is solid, large capex or R&D overruns could trigger financing that dilutes shareholders.

All items above are documented in the Q2 2025 10-Q and company press releases.

Valuation & scenario analysis

Model inputs: Q2 2025 LTM revenue ≈ $436M (TradingView FY figure), cash & marketable securities $749.3M, net debt approximate $ (debt principal ~$427.1M minus cash) ≈ net cash/(debt) position to be interpreted relative to enterprise value. Market cap ≈ $22.4B.

Method: simple revenue multiple framework and a split valuation that isolates base Electron/space-systems business from Neutron option value.

- Conservative scenario – Price target $22: assume market assigns 8× revenue to core space systems/launch services (discounted for risk), and Neutron option value = $0 until demonstrated; apply net debt. Rationale: launch failures or sustained delays and slower cadence.

- Base scenario – Price target $40: assume 20× revenue multiple to combined business reflecting scale-up, partial Neutron value recognized contingent on successful static fires and first launch within 12 months, and stable backlog execution.

- Optimistic scenario – Price target $62: assume 35× revenue multiple plus full recognition of Neutron optionality and high government program capture; multiple justified by sustained high margins and large addressable TAM capture.

Interpretation: current market pricing implies aggressive recognition of Neutron and sustained high launch cadence; upside requires execution while downside is substantial if technical or schedule risks materialize.

Trading checklist & signals

Momentum trader rules

- Entry: initiate on pullback to 50-day SMA (~$46.33) confirmed by MACD positive crossover and volume above 20-day average.

- Stop: 8–12% below entry; hard stop below 200-day SMA to preserve capital.

- Position sizing: 2–5% of portfolio for momentum exposure; scale out in 25–40% tranches at resistance bands and ahead of major Neutron milestones.

Longer-term investor checklist

- Sizing: limit to 1–3% of core equity allocation unless investor explicitly targets high-beta space exposure.

- Confirmatory indicators before increasing exposure: (1) sustained quarter-over-quarter launch cadence growth, (2) Neutron static test success and a scheduled maiden flight within guidance window, (3) backlog conversion rate and defense program awards visible in filings.

- Risk controls: maintain written re-evaluation triggers (missed launch windows, cost overruns >20% of guidance, material debt covenant amendments).