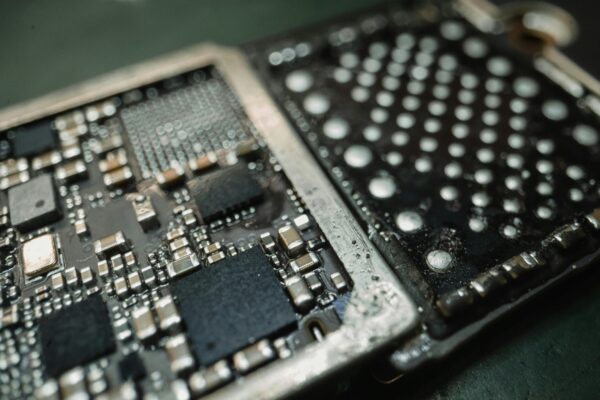

Top Small-Cap Semiconductor Stocks With Strong Gross Margins

Executive summary The focus keyphrase small cap semiconductor stocks high gross margin 2025 appears in this summary because high gross margins materially change risk/reward for small-cap chip names. The rest of this report analyzes fundamentals, momentum, peers, recent catalysts, and concrete trading rules. Summary fundamentals Numbers are latest reported quarter or company disclosure referenced directly….