Servicenow Moveworks Antitrust – What Investors Must Know

Executive summary Summary fundamentals Detailed fundamental analysis Revenue trends ServiceNow’s subscription revenue growth remains the…

Executive summary Summary fundamentals Detailed fundamental analysis Revenue trends ServiceNow’s subscription revenue growth remains the core story. The company reported subscription revenue of $3.113B in Q2 2025, a 22.5% increase year-over-year, reflecting large-enterprise adoption of AI-enabled workflow tools and expansion outside traditional ITSM use cases. Customer expansion metrics showed continued growth in high-ACV accounts. Moveworks,…

Executive summary Summary fundamentals Below are the latest quarter headline fundamentals and market metrics pulled from company releases and market data. Each metric cites the primary source. Northrop Grumman Corporation (NOC) L3Harris Technologies (LHX) Iridium Communications (IRDM) Parsons Corporation (PSN) Detailed fundamental analysis Revenue trends and contract composition Government-funded work distinguishes these names from capital-intensive…

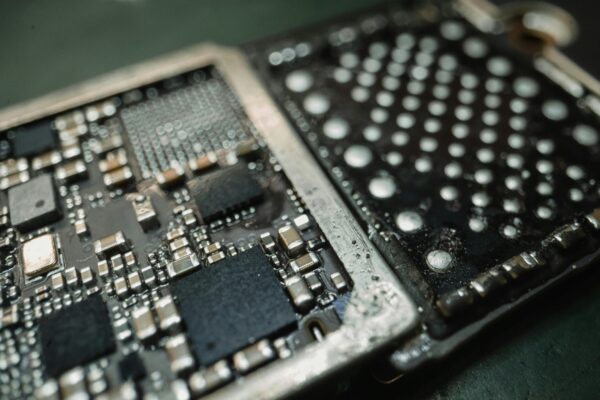

Executive summary The focus keyphrase small cap semiconductor stocks high gross margin 2025 appears in this summary because high gross margins materially change risk/reward for small-cap chip names. The rest of this report analyzes fundamentals, momentum, peers, recent catalysts, and concrete trading rules. Summary fundamentals Numbers are latest reported quarter or company disclosure referenced directly….

Executive summary Summary fundamentals All figures are the latest reported quarter or the most recent company disclosure cited. Detailed fundamental analysis Revenue trends Margin drivers Balance-sheet strength Valuation multiples (TTM & forward) Momentum & technical snapshot Note: technical indicators change intraday. The following snapshot is built from the latest public market data referenced near October…

Executive summary Summary fundamentals Below are the latest reported quarter headline metrics for each candidate (company press releases or investor pages cited). Market-cap and valuation snapshots move intraday; use the investor links in the Tickers section for live quotes. Detailed fundamental analysis Why choose these names: the value + growth filter We defined undervalued AI…

Executive summary (First 100 words include the focus keyphrase: crowdstrike vs sentinelone vs palo alto comparison 2025.) Summary fundamentals All figures are latest reported quarter per company filings and earnings releases. Detailed fundamental analysis Business models and TAM exposure CrowdStrike operates a cloud-native endpoint protection platform (Falcon) with subscription and ARR economics. Scale is the…

Executive summary Summary fundamentals Detailed fundamental analysis Revenue trends and addressable markets NVIDIA’s revenue performance is dominated by datacenter AI compute. Q2 fiscal 2026 showed $41.1B of data-center sales – the vast majority of NVIDIA’s top-line growth and the clearest indicator of AI infrastructure demand. That scale gives NVIDIA leverage across DGX/GB200/Blackwell systems, software, and…

Executive summary Summary fundamentals Detailed fundamental analysis Revenue mix and staking mechanics Coinbase’s revenue base in Q2 2025 is split between transaction revenue (primarily trading), subscription and services (stablecoin revenue, blockchain rewards, custody, prime financing), and interest/other. Transaction revenue was $764.3M while subscription and services contributed $655.8M; blockchain rewards accounted for $144.5M within subscription and…

Executive summary Summary fundamentals Detailed fundamental analysis Business model split: treasury company vs software vendor MicroStrategy’s public identity shifted in 2025 when it formally rebranded to Strategy Inc.; the business now publicly describes itself as a Bitcoin Treasury Company while continuing to operate its long-standing enterprise-software business (product licenses, subscriptions, support). The two cash engines…

Executive summary Summary fundamentals (Note: latest-quarter figures are company-reported; market caps reflect public market snapshot at reporting.) Detailed fundamental analysis Where the economics sit: cloud + models + human review Generative AI content moderation operates as a three-layer stack: inference infrastructure (GPUs, networking), platform services (managed LLMs, safety APIs), and human review/outsourcing to resolve edge…